Your Home. Your Life. Elevated.

Solar ITC Gets a Two Year Extension

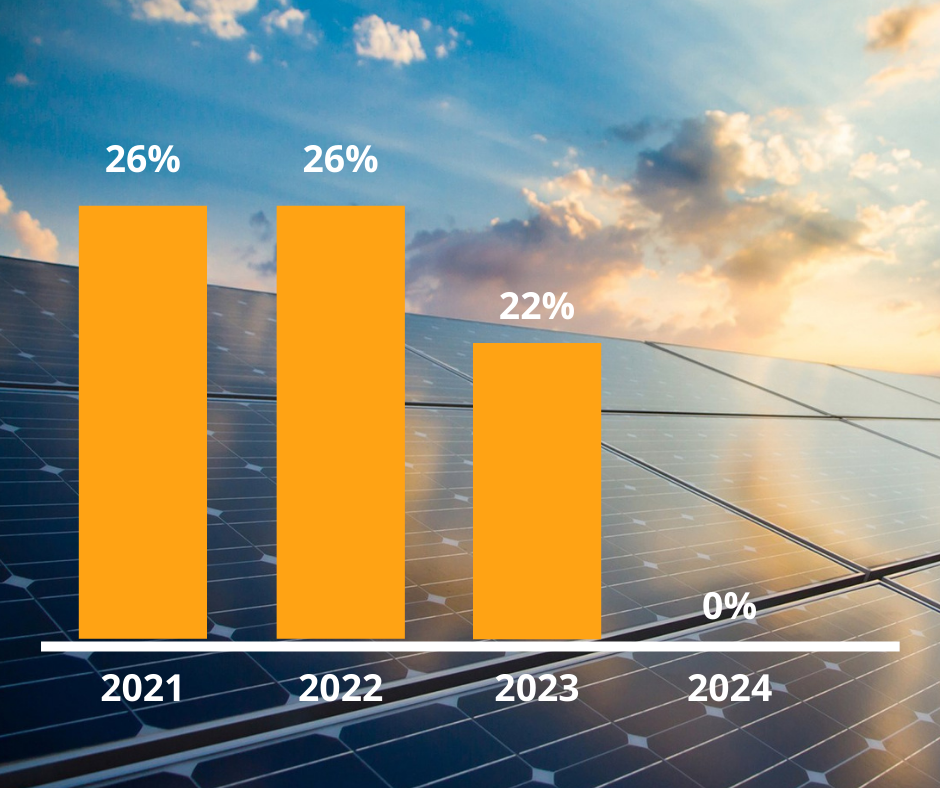

On December 21, 2020, Congress passed a bill to extend the solar investment tax credit (ITC) an additional two years. It was included in a $1.4 trillion federal spendings and tax extension package. This is great news for homeowners because it was scheduled to drop down to 22% this year.

How it Works & Why It Is Important

Right now, the ITC is worth 26% of your total system cost. This includes the value of parts and contractor fees for the installation. For example, if it costs $10,000 to buy and install your system, you would be owed a $2,600 credit.

The ITC was scheduled to drop to 22% in 2021 and disappear for residential installations in 2022. This means that the extension will be saving eligible homeowners thousands of dollars on their system. The tax credit is again scheduled to drop to 22% in 2023 and expire in 2024. There may be another extension but we recommend not waiting to find out.

Am I Eligible?

We always recommend checking with your tax professional, but most homeowners do qualify.

- You must be employed and be paying income tax. To claim the credit, you must file IRS Form 5695 as part of your tax return.

- You must own your system (purchase through cash or through financing). Leases and PPAs do not qualify.

- The system must be located at your primary residence. You can’t claim the credit for a rental or vacation home.

Check out our blog on how to claim the tax credit for more information.

See How Much You Can Save With Solar

While we support solar installations any time of year, there’s truly no better time than before the demanding afternoon of Summer to install and begin building those reserve credits. As utility rates continue to increase and in an increasingly unpredictable world, installing solar panels (and batteries, should you choose the added protection) is the best way to take control of how you power your home. If you’re ready to learn more or make the switch, schedule your free virtual consultation today.

*Important Disclaimer: Elevation Home Energy Solutions is passionate about helping you build an Elevated home. Please consult with your tax professional to verify all tax codes applicable to your unique situation.