Your Home. Your Life. Elevated.

How Do I Claim the Solar Tax Credit?

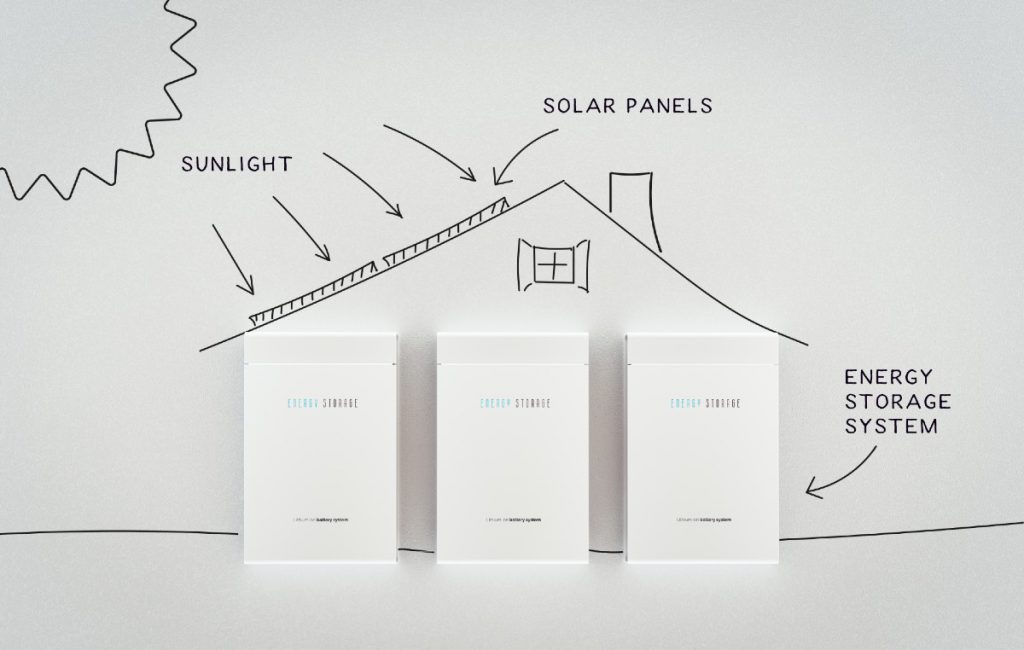

If you’ve recently purchased solar or looked into getting a quote for your home, you’re likely familiar with the Investment Tax Credit (ITC). There’s a lot of hype about the 26% ITC going away, and we’re here to explain why taking advantage of this significant tax credit NOW is crucial. We’ll also link you to a step-by-step guide to qualify and submit your solar tax forms. It’s easier than you think!

History of the Solar Tax Credit

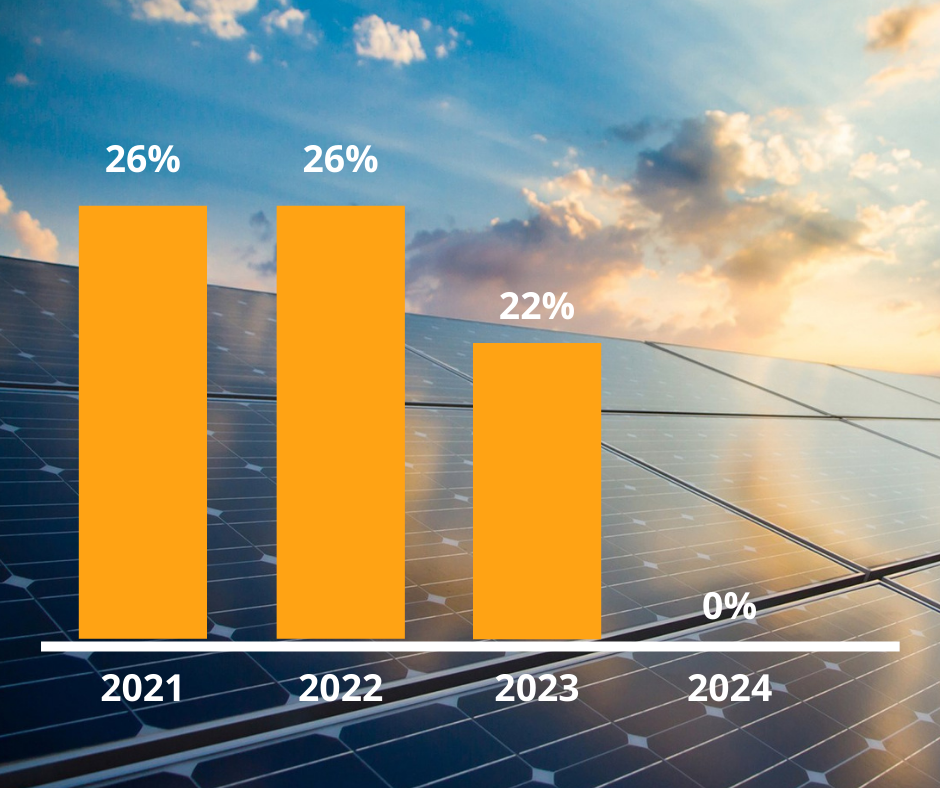

By definition, a tax credit is a dollar-for-dollar reduction in the income taxes that a person would typically pay the federal government in a given year. For qualifying customers, solar systems that begin construction (leasing and PPA do not qualify) by the end of the year 2020 will receive a 26% ITC on their overall system price. Below you’ll see the ITC schedule and the projection to bottom out by the end of 2021, according to the SEIA (Solar Energy Industries Association).

Take Advantage of the 26% Credit Before It’s Too Late

There are five basic steps to going solar, but with inspection and design delays caused by the COVID-19 pandemic, your final proposal to approval to flip on the switch and use power by the sun can take anywhere up to 2-3 months. Solar is an excellent investment, and as such, it requires careful engineering, planning, financing, and professional installation. Each jurisdiction requires different inspections along the way and should be understood when thinking about your solar timeline. Solar companies are seeing more excitement than ever regarding residential solar, and last-minute end of year shoppers will find they will need to wait until the new year to enjoy savings and pass up on the 26% credit.

Did You Know the Extra Tax Credit Rolls Over?

Another bonus is that if the tax credit is greater than the amount you owe in federal taxes for the year, it can be rolled over to the next year as long as the ITC is still relevant. With the ITC set to decrease to 22% in 2021 and disappear entirely in 2022, waiting will jeopardize this potential rollover.

Step-by-Step Guide to Claim Your Solar Tax Credit

EnergySage breaks down the three steps you need to take to claim the solar tax credit. We’ve included them below.

- Determine if you are eligible- Make sure you have enough tax appetite to use the federal ITC against your total taxes. Remember, anything extra is eligible to roll over the next year.

- Complete IRS Form 569 –This form validates your qualification for renewable energy credits and can be obtained online.

- Add your renewable energy credit information to your typical Form 1040- Loop your renewable energy credit information into your regular tax form.

You can find the detailed step-by-step instructions on the steps above and learn about filling out your forms here. There are also many local tax incentives and rebates available. For more information about incentives available by state, visit dsireusa.org.

Interested in seeing if solar is right for you? Schedule your free solar consultation today where our expert solar consultants can help build the system that is perfect for your needs. If you are already an Elevation solar customer, talk to your friends and family and join our customer referral program!

*Important Disclaimer: Elevation Home Energy Solutions is passionate about helping you build an Elevated home. Please consult with your tax professional to verify all tax codes applicable to your unique situation.